LAST WEEK IN REVIEW

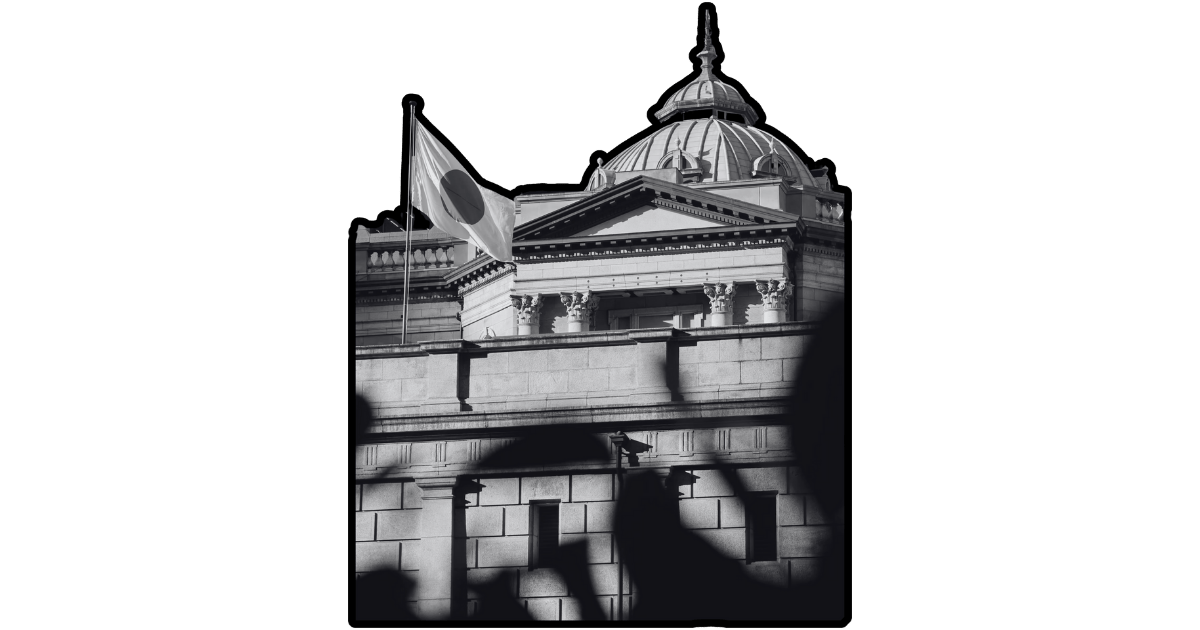

Bank of Japan Hikes Rates; Global Yields Diverge The Bank of Japan raised its benchmark interest rate by 25 basis points to 0.75%—a level unseen since 1995—sending Japanese Government Bond yields to multi-decade highs. This marks the end of the "cheap yen" era; as Japanese yields rise, domestic investors may retreat funds from U.S. markets.

Labor Market Softens: Unemployment Hits 4.6% While November payrolls rebounded by 64,000 following October's strike-and-storm-driven losses, the unemployment rate unexpectedly climbed to 4.6%, a multi-year high.

Inflation Cools to 2.7%, Supporting Fed Cuts Headline CPI rose just 0.2% for the month and 2.7% year-over-year, coming in below estimates and marking the lowest annual reading since July.

TikTok Secures U.S. Future with 'Project Texas' Revival TikTok announced a binding agreement to sell a 50% controlling stake of its U.S. operations to a consortium led by Oracle and Silver Lake, aiming to close by Jan 22, 2026.

Trump Media Surges 40% on Nuclear Fusion Merger Shares of Trump Media ($DJT ( ▲ 0.83% )) skyrocketed after announcing a $6 billion merger with TAE Technologies, a private fusion energy firm backed by Google and Goldman Sachs.

Consumer Sentiment Plunges as Reality Bites The University of Michigan Consumer Sentiment Index remains depressed, down nearly 30% year-over-year, as families grapple with the cumulative effect of high prices and job insecurity.

Retail Sales Show Hidden Strength Headline retail sales were flat (0.0%), but the "Control Group"—which excludes volatile items like gas and autos and feeds into GDP calculations—surged 0.8%.

YOUR WEEKLY FORECAST

Tuesday, December 23

Data:

- Q3 GDP – Advanced Reading

- Durable Goods Orders

- Industrial Production & Capacity Utilization

- New Home Sales

The Advisor's Take: This is effectively the last "real" trading day of the year for institutional desks, so expect condensed volatility.

- The Hard Data: We get a look at Durable Goods Orders. Investors strip out the volatile transportation sector (like Boeing jets) to see if businesses are actually spending on capital equipment (CapEx). If "Core Capital Goods" orders are rising, it’s a bullish signal for the industrial sector ($XLI) and suggests CEOs are confident enough to spend cash.

- Inflation Watch: Keep an eye on Capacity Utilization. This measures how "full" the nation's factories are running. If this number creeps too high (above 80%), it historically signals supply bottlenecks that lead to inflation. If it drops, it signals economic slowing.

- GDP: The "Advanced Reading" for Q3 GDP is likely a final revision. Unless it deviates wildy from consensus, markets ($SPY) will likely ignore it as "old news," focusing instead on the forward-looking New Home Sales data to gauge consumer confidence heading into 2026.

Wednesday, December 24

Data:

- Initial & Continuing Claims

- EIA Crude Oil & Natural Gas Inventories

- MBA Mortgage Applications

The Advisor's Take: Markets close early Wednesday (typically 1:00 PM ET for stocks, 2:00 PM ET for bonds). Volume is typically low on the 24th of December.

- The Trap: "Low liquidity" means there are fewer buyers and sellers. If a surprise number hits the wire—specifically regarding Initial Jobless Claims or Oil Inventories ($USO)—price moves can be exaggerated because there isn't enough "depth" in the market to absorb the orders.

- Labor Health: We are watching Continuing Claims closely. If this number ticks up, it means people who lost their jobs are staying unemployed longer, a classic early recession warning that could boost bonds ($TLT).

- Energy: With travel peaking for the holidays, the EIA Crude Report will give us a read on implied gasoline demand. A draw in inventories (suggesting high demand) could give energy stocks ($XLE) a final year-end pop.

Holiday Schedule Note

Thursday, Dec 25: Markets CLOSED for Christmas.

Friday, Dec 26: Expect extremely thin volumes as many traders extend the holiday weekend.

HALAL STOCK SPOTLIGHT*

All stocks are screened for sharia-compliance on Zoya. We also exclude companies in the following three databases: WhoProfits.org, The Official BDS Targets, The American Friends Service Committee Database

Merck ($MRK ( ▲ 1.82% ))

The Business Model Merck is a global biopharmaceutical company that generates revenue through the discovery, development, and commercialization of prescription medicines and vaccines, with a significant concentration in oncology, infectious diseases, and diabetes treatments.

The Bull Case Bulls argue that the company's valuation remains attractive relative to its long-term growth prospects, driven by a maturing pipeline in oncology and infectious diseases and strategic business development like the planned acquisition of Cidara Therapeutics. Additionally, the recent agreement with the U.S. administration to avoid Section 232 tariffs in exchange for pricing concessions is viewed as a stabilizing factor that protects the company's manufacturing interests and removes a key layer of regulatory uncertainty.

The Bear Case Risks include the looming patent expiration of the blockbuster drug Keytruda, which creates a significant "valuation overhang" and raises concerns about the company's ability to replace revenue post-2028. Furthermore, skeptics point to declining returns on research and development spending and the negative impact of Medicare price negotiations on established drugs like Januvia as headwinds that could compress future profit margins.

*Please read the disclaimer at the end of this email before forming any opinions on the stock.

MONEY TALKS

Q: I missed the Bitcoin boat, but I’m looking at other coins. Is crypto generally halal, or is it all just digital gambling?

The scholarly consensus on crypto has matured significantly. Bitcoin and major cryptocurrencies are increasingly viewed as digital assets or currencies (Maal), making them permissible to buy, hold, and sell.

But the "Halal" label isn't a blanket approval for the entire ecosystem. You have to look at the utility:

The Green Light: Buying a token because you believe in the technology, the store of value, or the utility of the network is generally fine.

The Red Light:

Staking/Lending: Many platforms offer "yield" for locking up your crypto. If this yield comes from lending your coins out for interest, it is Haram.

Meme Coins: Buying a coin with zero utility (like the latest dog/frog coin) purely in hopes of selling it to a "greater fool" for a profit is considered gambling (Maysir).

Leverage: Trading crypto on margin (borrowed money) or futures is almost universally prohibited.

Buy the asset, hold the asset (HODL), but stay away from the lending protocols.

In today’s world, who you know is becoming more important than what you know. Join the largest online community of Muslim professionals in North America at muslimprofessionals.us.

That's all for this week. Make it a great one.

IMPORTANT LEGAL DISCLAIMER*

Please read this disclaimer carefully before proceeding. By reading and using the information provided in this newsletter, you acknowledge and agree to the terms outlined below.

1. Not Financial or Investment Advice The content provided in this newsletter, including all articles, market analysis, economic news, stock picks, trading plans (including entry prices, stop losses, price targets), catalysts, and risk assessments, is for educational and informational purposes only. It should not be construed as financial, investment, tax, legal, or any other form of professional advice. No fiduciary relationship is created by your subscription to or use of this newsletter.

2. Consult a Professional Advisor The author(s) and publisher of this newsletter are not licensed financial advisors, registered investment advisers, or broker-dealers. You should not make any investment decision based solely on the information presented here. It is imperative that you consult with a qualified and licensed financial professional to determine if a particular investment or strategy is suitable for your individual financial situation, risk tolerance, and investment objectives.

3. Inherent Risk of Investing All forms of investing carry significant risk. The stock market is volatile, and you may lose some or all of your invested capital. There is no guarantee that any of the strategies or stock picks discussed will be profitable. Past performance is not indicative of future results. Never invest money that you cannot afford to lose.

4. No Guarantee of Accuracy or Completeness While we strive to provide accurate and up-to-date information, we make no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, availability, or completeness of any information in this newsletter. We are not liable for any errors, omissions, or for the results obtained from the use of this information. All information is provided on an "as-is" basis.

5. Disclaimer on "Halal" and Shariah Compliance The term "halal stock picks" refers to securities that have been screened against certain publicly available, third-party Shariah-compliance criteria at the time of publication. These standards can vary among different scholars, organizations, and screening services. The Shariah-compliant status of a company can change over time. We make no guarantee or warranty as to the Shariah-compliant status of any security mentioned. It is your sole responsibility to conduct your own due diligence and consult with your own qualified religious scholar to determine if an investment aligns with your personal Islamic principles.

6. Separation from Muslim Professionals of the Americas This newsletter is an independent publication. The views, thoughts, and opinions expressed herein belong solely to the author(s) of the newsletter and do not represent the views, policies, or official positions of the nonprofit organization Muslim Professionals of the Americas, its board of directors, officers, or members. Muslim Professionals of the Americas is a separate legal entity and assumes absolutely no liability or responsibility for the content of this newsletter, any financial losses, or any other damages incurred from its use.

7. Personal Holdings The author(s) of this newsletter may, from time to time, hold positions in the securities mentioned herein. The presentation of any stock is not a solicitation or direct recommendation to buy or sell that security.